China’s recent economic resurgence has significantly influenced global oil markets, leading to a notable increase in prices. In March 2025, China’s crude oil storage surged, reversing earlier drawdowns from the year’s first two months. Refinery processing reached its highest level in a year at 14.85 million barrels per day (bpd), yet crude availability surged even more due to increased imports and strong domestic production. This led to a surplus of 1.74 million bpd, the largest since June 2023. Imports rose 5% year-on-year to 12.11 million bpd, augmented by 4.48 million bpd of domestic output, the highest since mid-2011.

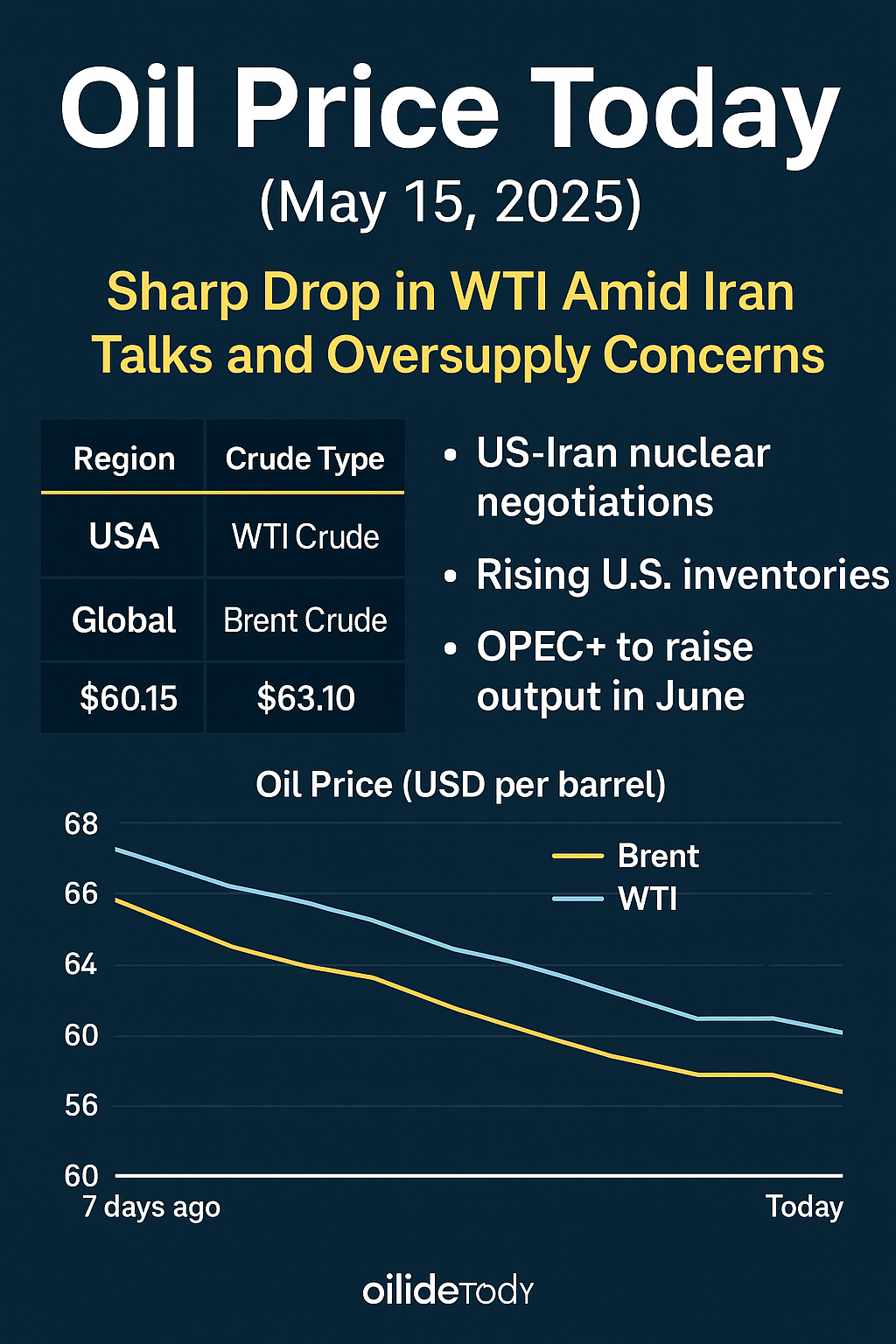

The upward momentum in oil prices was further bolstered by geopolitical developments. China’s announcement of its openness to trade talks with the United States sparked optimism for a potential resolution to ongoing trade tensions. Brent crude futures increased by 49 cents to $62.62 per barrel, and U.S. West Texas Intermediate gained 50 cents to $59.74. Additionally, President Trump’s threat to impose secondary sanctions on buyers of Iranian oil reinforced his “maximum pressure” policy, contributing to the price uptick.