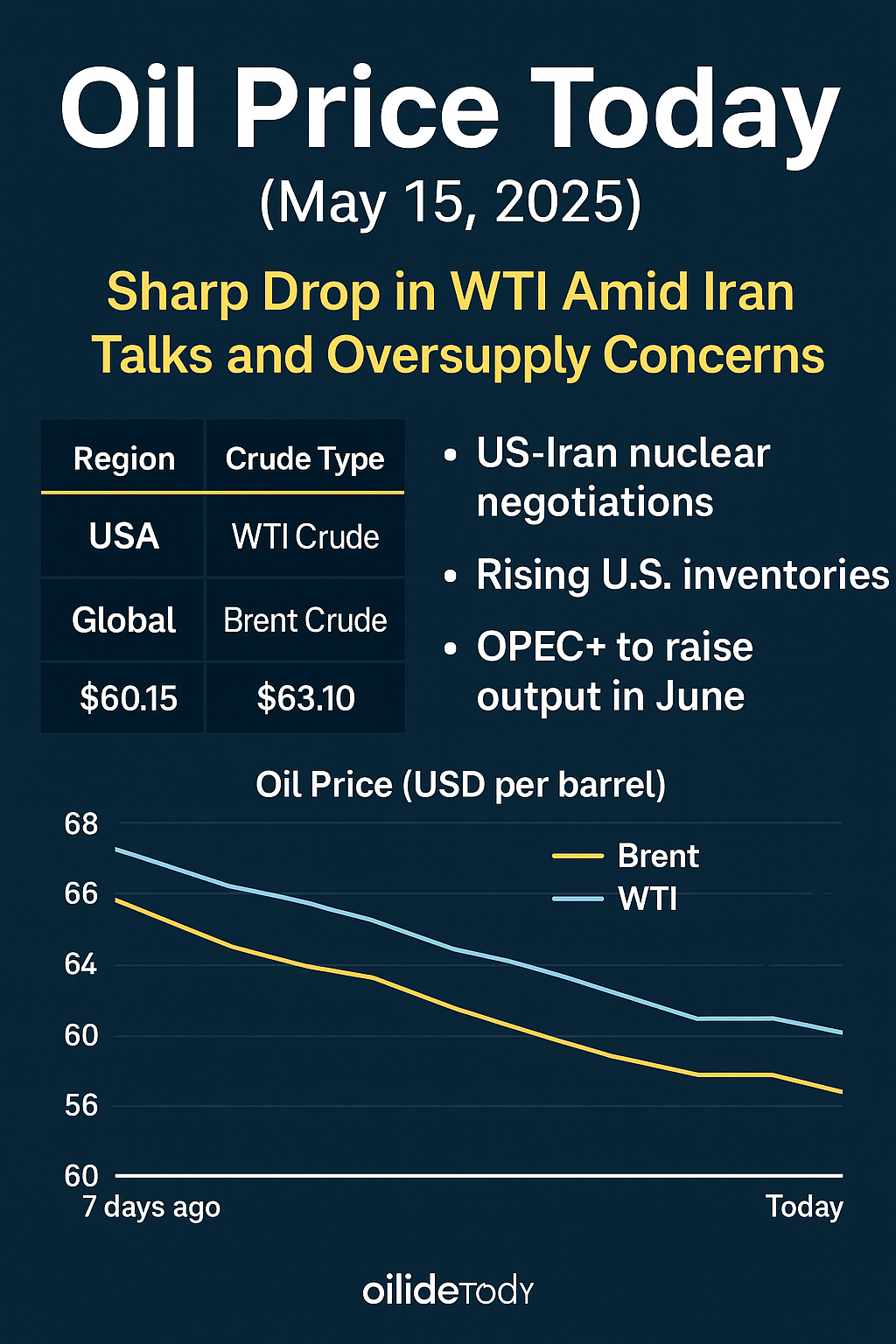

Oil price today shows a sharp drop across major benchmarks as of May 15, 2025. Both WTI and Brent crude prices have declined due to U.S.-Iran nuclear talks, rising inventory levels, and OPEC+ production increases.

📉 Current Oil Prices Snapshot

| Region | Crude Type | Price (USD/barrel) |

|---|---|---|

| USA | WTI Crude | $60.15 |

| Global | Brent Crude | $63.10 |

| UAE | Dubai Crude | $62.45 |

| Singapore | Tapis Crude | $66.20 |

| India | Indian Basket | $62.75 |

| China | Daqing Crude | $64.30 |

Over the past seven days, WTI has dropped 4.7%, while Brent is down 3.8%. These price movements reflect a global oversupply narrative, despite a modest rise in long-term demand projections.

📊 Oil Price Trend: 7-Day Graph Overview

Both WTI and Brent benchmarks have trended downward consistently. Traders are reacting to both macroeconomic indicators and news around key oil-producing nations, especially concerning U.S.-Iran talks and OPEC+ production policy.

🌍 What’s Driving Oil Price Today?

1. 📰 US-Iran Nuclear Negotiations

The revival of nuclear talks between the U.S. and Iran has increased expectations of lifted sanctions, which may release millions of barrels of Iranian crude into global supply.

2. 📈 US Inventory Surprise

According to the EIA, U.S. crude oil stocks rose by 3.5 million barrels last week — well above forecasts. This has directly impacted oil price today, as oversupply fears grow.

3. ⛽ OPEC+ to Raise Output in June

OPEC+ confirmed a 411,000 bpd output increase starting next month. This adds further downward pressure on prices, especially for WTI and Brent crude.

🌐 Oil Price Today – Regional Breakdown

🇺🇸 United States (WTI)

Oil price today: $60.15

Inventory builds and weaker refining activity are softening demand.

🇪🇺 Europe (Brent)

Oil price today: $63.10

Stabilized gas prices and easing North Sea constraints influence the Brent curve.

🇨🇳 Asia (Tapis, Daqing)

Singapore’s Tapis crude holds at $66.20.

India and China are accumulating reserves due to favorable oil price today levels.

📈 Forecast: Where Is Oil Headed Next?

The International Energy Agency expects global oil demand to grow 1.4M barrels/day this year. However, the EIA predicts WTI could drop to $54 by Q4 2026.

“Oil price today is volatile, but long-term direction will depend on diplomacy and discipline among producers.”

— Rohit Kapoor, GlobalCom Energy

📰 Top News This Week Affecting Oil Markets

1. 🇮🇷 US-Iran Nuclear Talks Resume

The Biden administration has restarted diplomatic negotiations with Iran regarding the nuclear agreement originally established under the Obama administration. This move could eventually result in lifted sanctions on Iranian oil exports, allowing millions of barrels per day to re-enter global supply.

Such developments traditionally place bearish pressure on oil markets, as traders anticipate future supply increases. According to FT, markets began pricing in these changes immediately after the announcement.

2. 🇺🇸 EIA Reports Surprise Crude Inventory Build

The U.S. Energy Information Administration reported a 3.5 million barrel increase in domestic crude inventories last week. This figure starkly contrasts with analyst expectations of a 1.1 million barrel drawdown.

This increase implies weaker refinery demand and/or higher production — both of which reduce short-term bullishness.

→ Reuters Source

3. 🛢️ OPEC+ Confirms June Output Expansion

In a widely anticipated move, OPEC+ will increase daily output by 411,000 barrels/day starting in June, citing growing demand in Asia and inventory needs in Europe. While this aims to stabilize member economies, it adds further pressure to already saturated markets.

→ Read the full story on Reuters

🌍 Regional Market Analysis

🇺🇸 North America: WTI Under Pressure

In the U.S., WTI remains below the psychologically important $61 level. Refineries are reporting lower capacity utilization, and gasoline demand in early May remains weaker than forecasted. The Midwest and Gulf Coast storage hubs are nearing capacity, signaling potential bottlenecks.

🇪🇺 Europe: Brent Faces Supply-Side Fluctuation

Brent crude is being influenced by North Sea output disruptions and higher-than-expected import flows from the Middle East. European economies like Germany and France are increasing alternative fuel subsidies, which may soften long-term oil demand.

🌏 Asia: Tapis and Daqing Stay Firm

Asian markets are cautiously optimistic. Chinese refiners are accelerating crude purchases to hedge against a weaker yuan. India, facing summer power demands, is increasing oil imports from the Gulf. Singapore’s refining margins remain healthy, propping up prices for Tapis crude.

📈 Forecast: Will Prices Fall Further?

Despite short-term bearish indicators, the International Energy Agency (IEA) projects a global demand increase of 1.4 million barrels/day for 2025, due to easing trade tensions and rebounding air travel.

Meanwhile, the U.S. EIA forecasts:

Q2 2025: WTI to average $60.85

Q4 2025: Brent to decline toward $58

Q4 2026: WTI to fall as low as $54 if supply outpaces demand

Long-term price sustainability will depend heavily on the outcome of Iran negotiations, OPEC+ compliance levels, and demand recovery in China.

🛠️ Expert Commentary

“The market is recalibrating. With Iran possibly coming back online, the focus is now on managing inventories and avoiding a glut,”

— Dana Glazer, Senior Oil Analyst at PetroVantage Group

“We’re seeing a soft patch in the U.S., but demand in Asia and Latin America continues to surprise to the upside.”

— Rohit Kapoor, Market Strategist, GlobalCom Energy

🔗 Related Articles

📣 Stay Ahead of the Market

Want daily insights on oil, gold, silver, and global finance?

🔗 Visit 👉 TodayPriceGold.com for trusted, up-to-date market intelligence you can rely on.

Subscribe to our newsletter and never miss a trend!